The Best Ways to Read Stock Market Chats to Understand the Current Trends

Introduction: How to read stock market charts

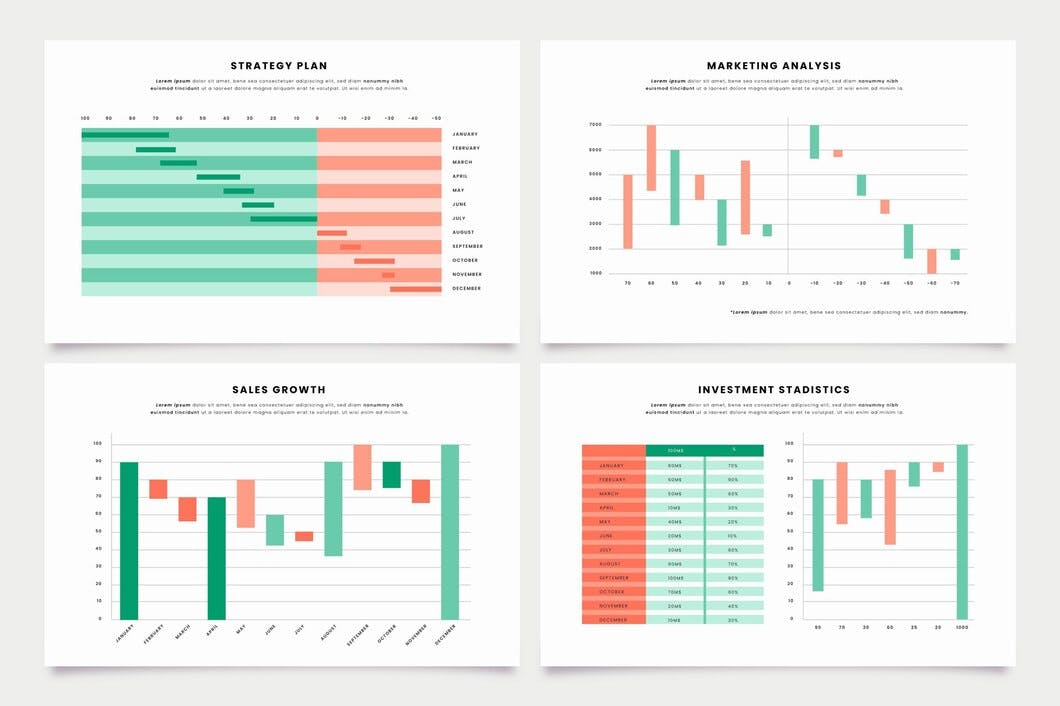

There are many different types of stock market charts. If you want to learn about reading and interpreting them, this section will show you the basics of each one. More than just decoration, stock charts allow investors to make predictions and see the trends in an industry or business over a long period of time. They are one of the most popular tools used by stock traders, investors and analysts alike to assess a company's performance and determine its potential for growth. A stock chart is an easy way to visualize trends in a company or industry over time. It is visually appealing - since graphs with lines that go up and down make people feel excited - which makes it interesting for investors who are looking for opportunities to buy stocks before they increase in value. You will comprehend the distinction between traded and invested assets, as well as how they interact on the global market. Take a look For additional information Join our Channel for the Trending Trending & Trending

Why should you know how to read stock charts?

The stock market is a $27 trillion dollar industry, so there's plenty of opportunity for those who know how to make the most of it. It's a fast paced world where decisions are made in seconds. It takes an expert to be able to read and understand the stock charts that represent this market. From a technical perspective, you will need to know how to interpret charts to use them as an analytical tool that predicts future stock prices. When you're reading charts, it's important that you understand the anatomy of them in order to comprehend what they're saying. Charts consist of different components such as candles, bars and trends which can help confirm or contradict your hypothesis on the current state of the market. We should also note that when reading charts it is important not only look at current data but also past data because this provides context for what we see today with regards to price movements and trends. We should also take into account external factors such as economic events or

How to Read a Stock Chart

1) Choose a time window:

The time window chosen will give the reader an idea of what the stock market is like at that time.

Day trading: Day trading is when a trader opens and closes positions within a day. Day traders are taking advantage of short-term price fluctuations and executing trades in securities, derivatives, or other financial instruments within a day or less.

Intraday Trading: Intraday trading differs from day trading in that it still involves opening and closing positions within one day, but it can be on the same trading day as the position is opened (e.g., on a Monday morning). In general, the stock market is open every day except Sundays and holidays. The time window for stock markets may vary from country to country. For example, in the United States, it is open from 9:30 AM EST until 4:00 PM EST on weekdays; while in Canada it opens at 9:30 AM EST and closes at 4:00 PM EST on weekdays; while in Australia it opens at 10:00 AM AEST and closes at 3:00 PM AEST on weekdays.

2) Note the summary key:

There are many different ways to categorize stocks. One way is by the type of company that the stock belongs to, such as large-cap stocks and small-cap stocks. Another way is by how stable the company is, like blue chip stocks and speculative stocks. If an investor wants a diversified portfolio of different types of stocks, they must pay attention to all these classifications and make sure that their portfolio matches their risk tolerance and investing goals. There is no single definition for "blue chip" stock, which makes it difficult to create a clear investment strategy with these types of investments. However, there are some general characteristics that most people would agree have something in common with blue chip stocks - they are stable companies seen as being valuable long term holdings with long histories of profitable growth. They also tend to be large companies traded on major exchanges like NYSE or NASDAQ (worth more than $5 billion).

3) Track the prices:

The stock market is designed primarily to provide an efficient way for people who need capital with close deadlines and people who have excess capital to get together and exchange their assets. The idea of the stock market is that stocks are a type of ownership of company stocks from which dividends are paid out as a form of return on investment. People buy these stocks in order to become the owners of the company, but this does not guarantee them any profits.The prices of stocks and other securities are determined in a market where prices can change quickly. The stock market is a system for buying and selling stocks, which are shares in the ownership of companies. The stock market is also called the equity market or the capital markets

4) Note the volume traded:

The volume of traded shares in stock market tells you about the liquidity of that particular stock. A high volume indicates that there are many people trading in a particular stock, which means it is more liquid. Whereas a low volume indicates that the liquidity is low and the price may not be accurate. When analyzing any given company’s financial performance, it is important to take into account its liquidity level. The higher the liquidity level, the more accurate the price of shares traded in that company would be because there are many traders willing to buy and sell them at any time.The stock market is a place where people buy and sell stocks. The stocks are shares of the ownership in a company. When people buy stocks, they are buying part ownership in that company.

5) Look at the moving averages:

Moving averages are a type of trend line that is used in technical analysis and can be applied to stocks. Moving averages are used to help traders identify the current trend and predict future market direction. The most common type of moving average is the simple moving average, which takes the arithmetic mean of all data points over a period of time. A moving average is calculated by summing up all the values in a set of data points and dividing this sum by the number of data points in that set. For example, to calculate a five-day simple moving average, you would take each day’s closing price and add it together then divide by five.

Conclusion:

The Importance of Knowing How to Read Stock Charts for Investors Stock charts are a graphical representation of data that helps investors make trading decisions. The stock charts show the value of a company or share over time. They provide information about the investor’s investment, such as its direction and volatility. The prices of most stocks are quoted in one dollar increments, which is known as the ticker symbol. When stock prices rise from $5 to $6, for instance, this is called a ticker symbol of TK (rather than TT). This can be confusing, but it is important for investors to be familiar with this format when looking at stock charts over time.