An Introduction to Fundamental Analysis and How it is Used in the Stock Market

What are the Different Types of Fundamental Analysis?

Fundamental analysis is a method of evaluating the intrinsic value of stocks. The process involves the analysis of factors such as balance sheets, trading history, and industry performance to assess the value of a security. There are three main types of fundamental analyses: qualitative, quantitative, and technical.

Qualitative Analysis: The qualitative approach focuses on interpreting how a company is doing financially by looking at its financial statements and other publicly available information. The evaluation that these analysts are using includes numbers but they also include subjective opinions.

Quantitative Analysis relies on mathematical tools to evaluate the company's worth. It uses things like P/E ratios and discounted cash flow models to determine if a stock should be bought or sold. Technical Analysis: Technical Analysis utilizes patterns found in securities prices over time to predict future price movements. This type of investment research requires knowledge about financial markets, economic trends, and past market activity for successful forecasting.

What is the Importance of Fundamental Analysis in the Stock Market?

Fundamental analysis is one of the three methods of analysis applied in stock trading. It is based on a rigorous study and comparison of the underlying fundamentals that influence the supply and demand for a specific stock or portfolio. Fundamental analysis is one of the three methods for analyzing stocks, alongside technical and sentiment analysis. Technical analysis looks at patterns in price movements, while sentiment analysis looks at investor psychology to determine which direction markets are likely to move in. However, fundamental analysts believe that they can't simply look at financial information like share prices or company revenues because all these things are influenced by other factors as well. Rather, they are interested in understanding how all these other factors impact the supply and demand for a specific stock or portfolio over time.

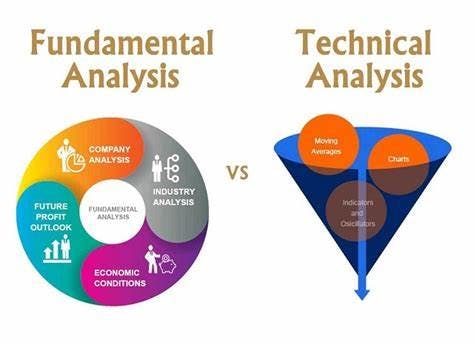

Fundamental Analysis vs. Technical Analysis

Fundamental analysis studies the value of a company and its management by examining macroeconomic, financial, and political indicators. This type of analysis doesn’t take into account the price movement or even the value of an individual stock.

Technical analysis, on the other hand, relies on past data points to predict future trends. It measures how a market is performing based on prices, trading volume, and different trading indicators like moving averages and oscillators. This information can be used to forecast trends

This type of analysis can be beneficial to investors who want to take advantage of short-term opportunities in the market as it doesn’t rely heavily on elements that are outside their control such as macroeconomic factors or politics.

The Importance of Understanding Fundamental Analysis in the Stock Market

It is important to understand what the fundamentals of a company are before investing in it. Fundamental analysis is key to determining if the stocks are valuable and have growth potential. The fundamental of an organization refers to an organization's financials, assets, liabilities, earnings, as well as its balance sheet. As a result, fundamental analysis is a way for an individual or organization to evaluate the worth of a company. Fundamental analysis studies the economic and financial conditions that affect the value of securities. It can be used for both short-term and long-term investment decisions. **

Conclusion: The Importance of Fundamental Analysis in Your Investment Strategy**

Fundamental analysis is an essential aspect of any investment strategy. The importance of fundamental analysis is apparent when we look at its role in the following 4 areas: The first area where fundamental analysis is important is when it comes to identifying the intrinsic value of an asset. A good fundamental analyst will undertake the required research on a company and evaluate its fundamentals to help identify its intrinsic value. This knowledge is then communicated to investors so that they can make informed investment decisions.

Investment management is a high-skilled profession that requires years of training to competently perform all of the necessary tasks. Check out other information Trending Trending & Tradiding

Another area where fundamental analysis plays a crucial role is in assisting analysts in determining a target price for an asset that has been undervalued by the market. A good analyst will research how stocks typically react in different economic environments and market conditions, as well as assess their assumptions on future economic conditions, to determine what price they think the stock should be trading at. If a company's stock falls below this price after it is recommended, then it could be seen as an attractive investment opportunity for investors who are comfortable with riskier